Every time the holiday season rolls around, I remember what it was like to live as a new immigrant in this country. Before I arrived in the United States, I never heard anyone say the words “Thanksgiving Day.” In my first years, I thought Thanksgiving Day was the day that you give thanks for all of the blessings you have received in your life.

I did learn everything that I needed to know about U.S. history and the harvest festival later on, but I have to admit that the holiday season makes me feel deep respect for this country. The holiday encourages me to stop and enumerate all of the reasons that I have to be thankful.

I highly recommend that you do something like that this time of year. The markets will be closed, so you have no reason not to place all of your attention on your loved ones and have a good time. After the holidays are over, you can start worrying about your investments again, so this article will be about the two mega-trends that I am going to cover in my newsletter Profits Unlimited next year.

The #1 stock to own in 2018 is…#stocks #investing #StockMarket #IoT #InternetOfThings #megatrends #BanyanHill https://t.co/XFha6Ieis1

— Paul Mampilly (@Paul_M_Guru) December 14, 2017

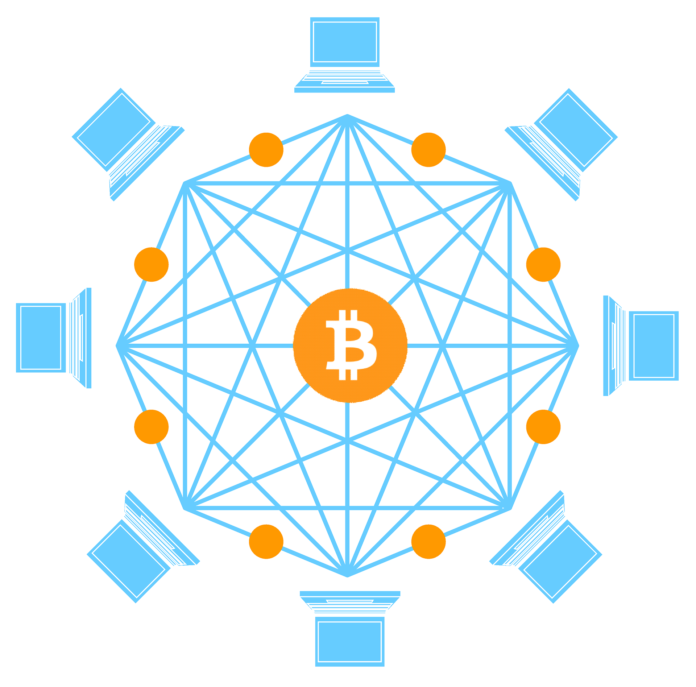

The first trend is “blockchain as it relates to finance.” You might have heard this term before, but if you need an explanation, I would be happy to give it to you here.

Blockchain is known as an “online global ledger” that is free for anyone to use, but this particular thing does not remain in one place. For example, it can be compared to an Excel spreadsheet. The spreadsheet can be on several computers all at the same time and updated every 10 minutes. Because the ledger is decentralized, hackers cannot encrypt it. It is also communal because the only thing that is needed is an internet connection to access the database.

This new technology has entirely changed the financial industry because this is the very first time that two different people can connect and exchange information without having to rely on entities such as government bodies, banks or rating agencies. The truth is that fraud, paperwork and fees are running rampant in the banking industry, so it is easy to see why more people are taking advantage of blockchain for their transactions.

Related: Microsoft is Using AI to Fight Climate Change

This technology is highly disordered, so it doesn’t surprise anyone that the global banking sector is doing everything it can to bring blockchain technology into its everyday practices. The fact is that blockchain has upset other entities as well. Suppose that the economy is completely decentralized, and there are no longer any middle men. Every industry on the planet would be affected by it. This is exactly the type of technology that I want to be involved in because it has the potential to bring investors nearly limitless returns.

Blockchain does have a major drawback, and it affects “the internet of things mega-trend.” Both of these up-and-coming industries require a monstrous amount of energy. As a matter of fact, researchers discovered that the bitcoin network will consume as much electricity as the country of Ireland consumes. So, we have to think about how much electricity would be needed if every bank on the planet began to deal in digital currencies in order to compete with everyone else.

Our current energy grid cannot sustain that amount of energy, and that’s why my Unlimited Profits portfolio will have renewable natural energy companies in the year 2018.

I don’t want to go into this in detail yet, but the two new themes and my current mega-trends are telling me that readers of Profits Unlimited are in for some exhilarating moments.

If you would like to have a chance to be introduced to the companies that will be exploiting the new themes, you may sign up for my newsletter. You will learn about my latest insights with regard to what is trending and how they relate to my core themes. You will also be introduced to the companies that are about to take command of a large part of the market.

I will end this chapter here, but my family and I would like to wish you a very happy holiday season.

About the Author, Paul Mampilly

In 1991, Paul Mampilly graduated from Montclair State University with a Bachelor of Business Administration. Also in 1991, he took his first job at Bankers Trust as an assistant portfolio manager. This is where he gained invaluable experience managing funds that were worth millions of dollars. In 1997, he graduated from Fordham Graduate School of Business with a Master of Business Administration.

In 2006, he became a hedge fund manager with Kinetics Asset Management and enjoyed an incredible amount of success with them. That was where he was responsible for increasing the firm’s assets to $25 billion. Barron’s took notice of this amazing accomplishment and listed Kinetics Asset Management as one of the “World’s Best” hedge funds.

Paul Mampilly is currently retired from the Wall Street rat race, but he has not left the business entirely. Now, he spends his time helping smaller investors make their trades and is having a much better time doing so. He currently writes two newsletters Profits Unlimited and Extreme Fortunes and has a research service called “True Momentum.”

For more information on Paul Mampilly or to sign up for his monthly newsletter, visit his website or connect with him on Facebook or Twitter.